How to deduct mileage for businessHow to deduct mileage for business

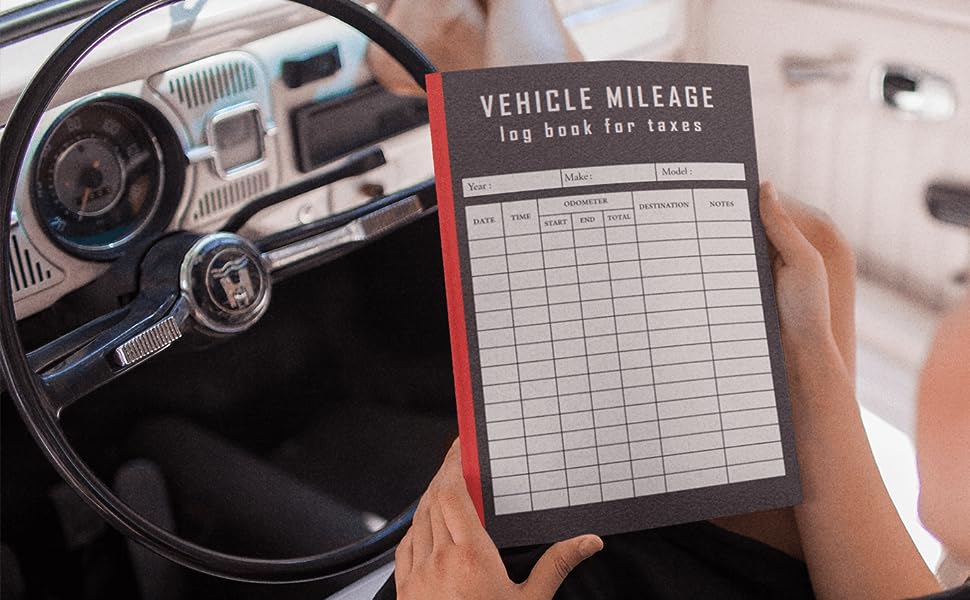

Proper mileage tracking is important incase of an IRS audit. Mileage can be tracked using a simple excel spreadsheet or even advance phone applications using GPS tracking. Amazon has log books for as low as $10 and it is recommended to keep a book in the car at all times. Phone applications range in price from $10 a month to $50. Standard mileage rate for 2023 will be .655 per mile.

Source for mileage: https://www.irs.gov/tax-professionals/standard-mileage-rates