I missed the tax file deadline. Now what?I missed the tax file deadline. Now what?

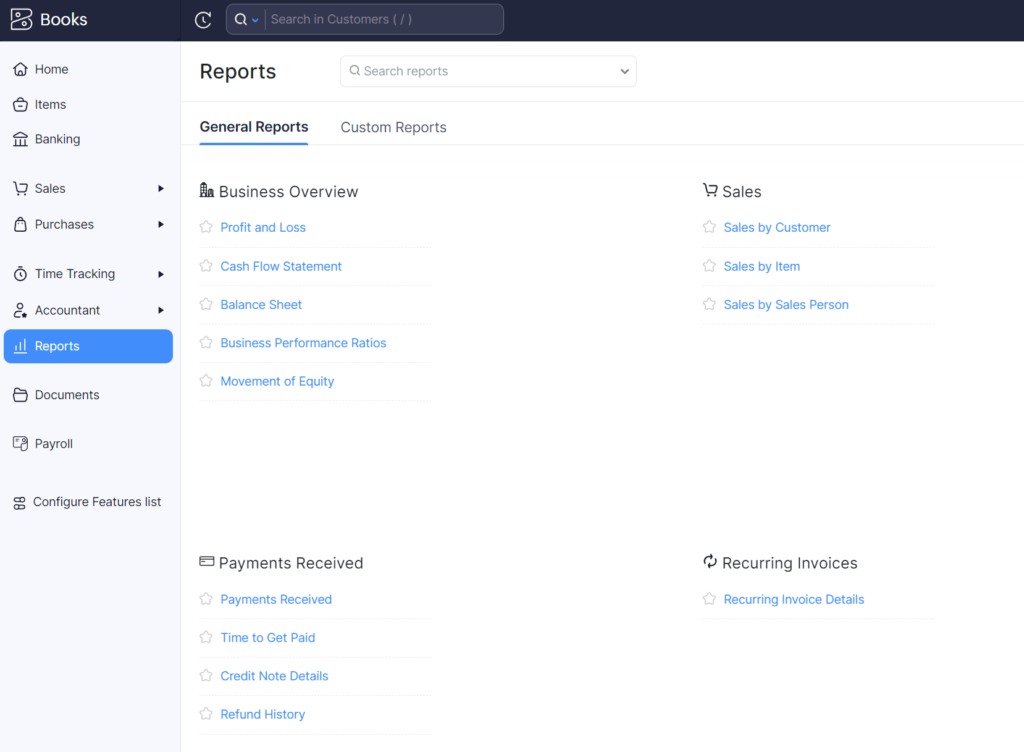

Missing the tax deadline is not good and could cost a lot in fees and interest. The table below comes from the IRS and demonstrates how the fee works out over time. One year of not filing leads to 35% increase in tax liability. One decade will double the taxes due. One advantage is that you must owe taxes for this fee to add up. The IRS will also not refund any amount due if no return is filed. Gooding CPA is here to help and can get all your returns filed quickly. Contact us today to discuss.

| Return Due Date (without extension) | Minimum Amount |

|---|---|

| On or before 12/31/2008 | $100.00 |

| Between 01/01/2009 and 12/31/2015 | $135.00 |

| Between 01/01/2016 and 12/31/2017 | $205.00 |

| Between 01/01/2018 and 12/31/2019 | $210.00 |

| Between 01/01/2020 and 12/31/2022 | $435.00 |

| Between 01/01/2023 and 12/31/2023 | $450.00 |

| After 12/31/2023 | $485.00 |