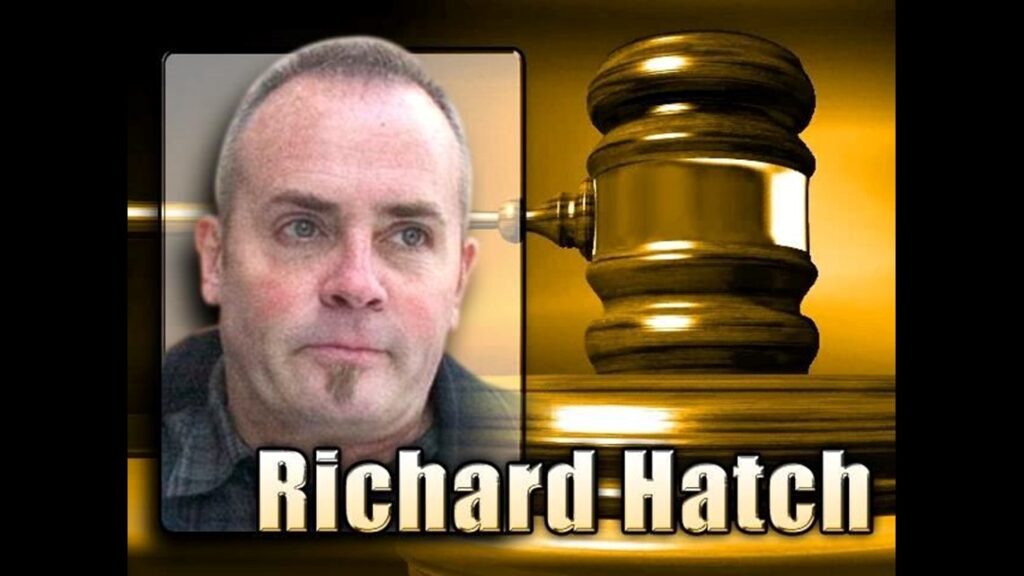

A federal judge sentenced Richard Hatch to 51 months in prison for evading income taxes. A jury found him guilty of tax evasion and filing a false return for not reporting to the IRS about $1,428,000 that he earned from the “Survivor” television series and other sources. Windfalls are rate but not uncommon and the IRS expects you to pay tax on them. Many people are shocked upon winning the lottery to see the IRS take almost half. The state governments holds lottery proceeds leading to less tax cases for the IRS. Television shows may hold tax but many do now. Not all windfalls are taxable though. Insurance proceeds for instance are taxed different then lottery winnings. If you have gotten a windfall from any source then contacts us today to see what taxes may be due.